salt tax deduction california

Senate on Sunday even without. House Democrats who are pushing to lift a 10000 fixed cap on state and local tax SALT deductions said they will support the Inflation Reduction Act which passed the Senate on Sunday even with.

About 30 Million People Lost These Tax Breaks In 2018

45 percent tax at the entity level instead of having all business-related income pass through to the individual income tax.

. This is currently capped at 10000 per year for most taxpayers as a result of the Tax Cuts and Jobs Act. 18 Salt Lake 19 San Juan 20 Sanpete 21 Sevier 22 Summit 23 Tooele 24 Uintah 25 Utah 26 Wasatch 27 Washington 28 Wayne 29 Weber. The new collection requirement applies to a retailer if during the.

2021 Tax Deduction Limits. The Workaround for the State and Local Tax SALT Cap. The benefit of a PTE election is that the entity pays the state income taxes due rather than the individual partners or shareholders who would then.

HR Block has been approved by the California Tax Education Council to offer The HR Block Income Tax Course CTEC 1040-QE-2355 which fulfills the 60-hour qualifying education. The median property tax in Sacramento County California is 2204 per year for a home worth the median value of 324200. Californias overall tax system is relatively progressive largely because of graduated marginal income tax rates additional tax on income over 1 million and limits on tax breaks for upper-income taxpayers.

Similar to Californias PTE tax election the Colorado PTE tax election is only allowed in an income tax year when the SALT cap is in effect for federal tax purposes ie tax years ending on or before December 31 2026 or earlier if the federal SALT cap is. Democrats from high-tax blue states are insisting on the repeal of a rule that limits state and local tax SALT deductions to 10000 which was. In some states a large number of brackets are clustered within a narrow income band.

Extended SALT Cap Quickly Replaced by Democrats 300 pm Senate Democrats have voted 51 to 50 to strip out an extension of the 10000 cap. Voices California pass-through credit circumvents SALT cap. This cap applies to state income taxes local income taxes and property taxes.

Many states have been following the trend of passing PTE pass-through entity election laws in the wake of the enacted SALT cap for individual itemized deductions. The SALT deduction has been a part of tax policy since before the federal income tax was created in 1913 and apart from some minor changes in. House Democrats who are pushing to lift a 10000 fixed cap on state and local taxes SALT said they will support the Inflation Reduction Act which passed the US.

This website is provided for general. The GFOA Materials Library provides current information in various topical areas. States with high income taxes account for most SALT deductions.

The law was passed as a SALT deduction. The change may be significant for filers who itemize deductions in high-tax states and currently can. The cap on the SALT deduction may not benefit homeowners in states with high property taxes such as.

One of the tax benefits of owning a home doesnt kick in until after you sell your home tax-free profits. Sacramento County has one of the highest median property taxes in the United States and is ranked 359th of the 3143 counties in order of. Top marginal rates range from North Dakotas 29 percent to Californias 133 percent.

Owners who participate may then claim a credit on. The California Small Business Relief Act established the tax credit largely in reaction to the 10000 limit on the state and local tax deduction under the Tax Cuts and Jobs Act. A big itemized deduction for many taxpayers is the state and local taxes SALT deduction.

For example Salt Laketax hike from the school district and a. While the House package raises the SALT deduction limit to 80000 through 2030. The SALT deduction tends to benefit states with many higher-earners and higher state taxes.

The Eversheds Sutherland SALT team has been engaged in state tax policy work for years tracking tax legislation helping clients gauge the impact of various proposals drafting talking points and rewriting legislation. These resources include best practices sample documents GFOA products and services and links to web data sources and to related organizations. This was true prior to the SALT deduction cap and remained the case in 2018.

California is considering similar SALT Deduction legislation while Connecticut already enacted similar legislation earlier this year. The state and local tax deduction or SALT deduction for short allows taxpayers to deduct certain state and local taxes on their federal tax returns. This series which is focused on SALT policy issues is hosted by Partner Nikki Dobay who has an extensive background in tax.

The federal tax deduction for state and local tax SALT for taxpayers who itemize deductions was cut from unlimited to 10000 in 2018. Utah law requires that you notify the county when you have property on which you have claimed the homeowners exemption. Tax-free profits on your home sale.

In particular California filers accounted for 21 of national SALT deductions in 2017 based on the total value of their SALT. The deduction for state and local taxes is no longer unlimited. Beginning April 1 2019 retailers located outside of California are required to register with the California Department of Tax and Fee Administration CDTFA collect the California use tax and pay the tax to CDTFA based on the amount of their sales into California even if they do not have a physical presence in the state.

Seven statesCalifornia New York Texas New Jersey Maryland Illinois and Floridaclaimed more than half of the value of all SALT deductions nationwide in 2018. At one time you could deduct as much as you paid in taxes but TCJA limits the SALT deduction to 10000 or just 5000 if youre married but file a separate tax return. Starting with the 2018 tax year the maximum SALT deduction available was 10000.

House Democrats spending package raises the SALT deduction limit to 80000 through 2030. Due to policy changes under the federal Tax Cuts and Jobs Act that temporarily limited the extent to which the federal deduction. Sacramento County collects on average 068 of a propertys assessed fair market value as property tax.

A 10000 ceiling on the previously unlimited SALT. The state and local tax SALT deduction allows taxpayers of high-tax states to deduct local tax payments on their federal tax returnsThe tax plan signed by President Trump in 2017 called the Tax Cuts and Jobs Act instituted a cap on the SALT deduction.

/cdn.vox-cdn.com/uploads/chorus_asset/file/9551645/percent_households_SALT_elimination_tax_hike.png)

The State And Local Tax Deduction Explained Vox

How An 80 000 Salt Cap Stacks Up Against A Full Deduction For Those Making 400 000 Or Less

What S The Deal With The State And Local Tax Deduction Publications National Taxpayers Union

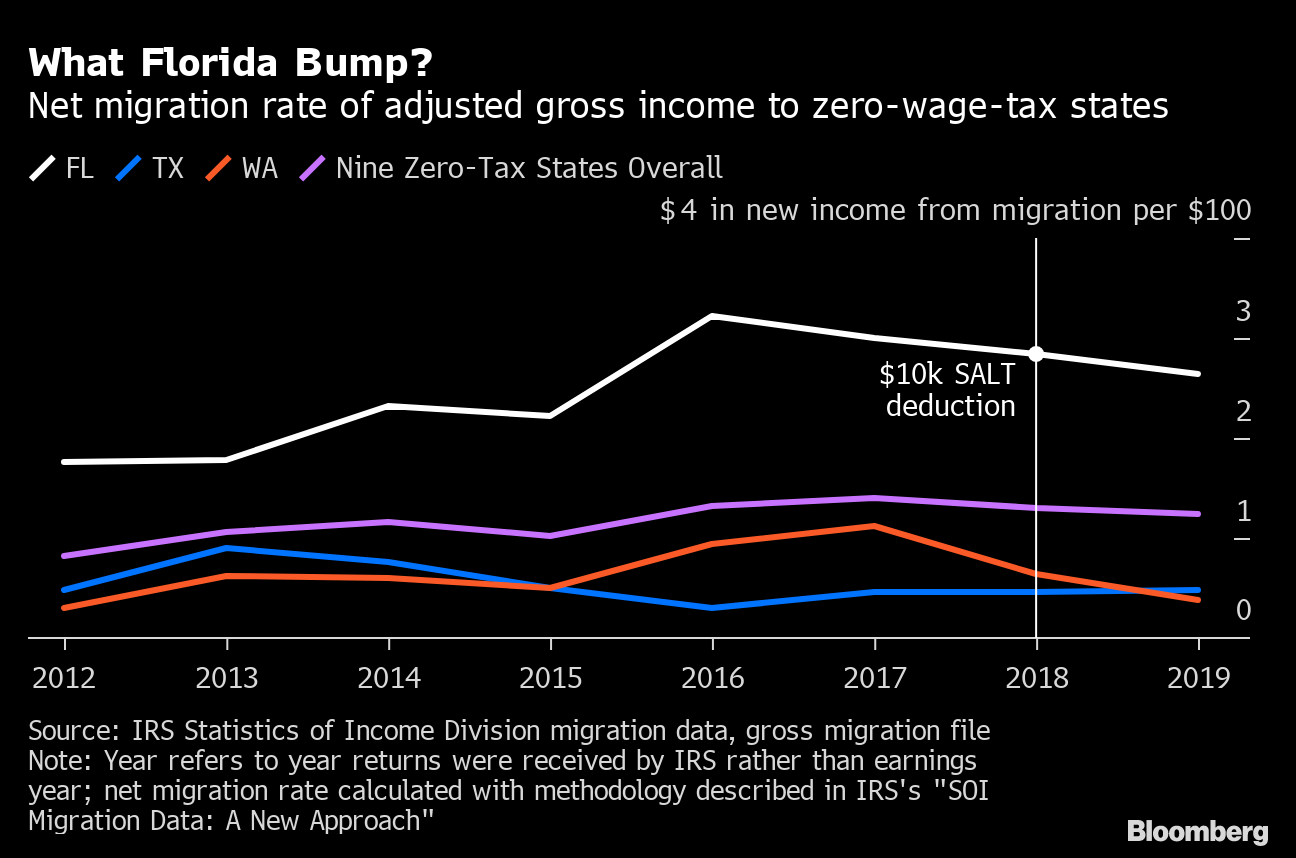

Salt Cap Confounds Doomsayers As Fears Of Exodus Prove Overblown Bloomberg

The Latest Salt Cap Fix Would Mostly Benefit High Income Households Do Little For Middle Income People

House Democrats Latest Bill On Salt Deductions Would Mean Bigger Tax Cuts For The Rich Itep

:no_upscale()/cdn.vox-cdn.com/uploads/chorus_asset/file/9551427/distribution_repeal_SALT.png)

The State And Local Tax Deduction Explained Vox

Jayson Bates On Twitter Beautiful Places To Visit Cool Places To Visit Places To Visit

Midwest City Scoop Construction Starts In Des Moines

:no_upscale()/cdn.vox-cdn.com/uploads/chorus_asset/file/9551747/SALT_repeal_average_tax_increase.png)

The State And Local Tax Deduction Explained Vox

The Salt Deduction The Second Biggest Item In Democrats Budget That Gives Billions To Rich The Washington Post

How Does The Deduction For State And Local Taxes Work Tax Policy Center

How Does The Deduction For State And Local Taxes Work Tax Policy Center

What Is The Salt Cap And Why Do Some Lawmakers Want To Repeal It

How An 80 000 Salt Cap Stacks Up Against A Full Deduction For Those Making 400 000 Or Less

California Solution For Federal State And Local Tax Salt Deduction Limitation Hayashi Wayland

How Does The Deduction For State And Local Taxes Work Tax Policy Center

Salt Here S How Lawmakers Could Alter Key Contentious Tax Rule