owe state taxes because of unemployment

Unemployment In CA Is Taxable. Yes you can owe taxes on unemployment payments because unemployment is taxable income.

Did You Collect Unemployment Benefits In 2020 Act Now To Avoid A Tax Day Surprise Dollars And Sense Abc10 Com

Thats money that could go to cover what income taxes you owe or possibly lead to a bigger federal income tax refund.

. Check all of the data you entered. You should receive a Form 1099-G from your state or the payor of your unemployment benefits early in 2022 for the unemployment income you received in 2021. When Gale Nichols received her tax forms last month she was in shock.

Since a composite return is a combination of various individuals. The American Rescue Plan Act of 2021 authorizes individual taxpayers to exclude up to 10200 of unemployment compensation they received in tax year 2020 only. You Could Owe 1200 In Federal Taxes On 300600 Unemployment Boosts.

The usual reason for owing state tax is that you did not have enough withheld from your paychecks---or perhaps from your unemployment. For those who do not normally earn this much and take. In the case of married.

In other states like California unemployment benefits are exempt from state tax. If you had taxes withheld on jobless benefits the federal taxes are withheld at a 10 rate. If your state of residence collects income taxes you may have to pay taxes on your benefits to both state.

It depends on what state you live in. Even though she opted to have California withhold 10 of her unemployment benefits the state did not take any. Do you have to pay state taxes on unemployment.

To do this you have to complete a Voluntary Withholding Request or Form W-4V with your state unemployment office. To do this you have to complete a Voluntary Withholding Request or Form W-4V with your state unemployment. Any money that you receive is subject to federal or state tax or both.

New Jersey has a graduated Income Tax rate which means it imposes a higher tax rate the higher the income. IRS employees at that line can help with a payment. If you actually owe unpaid taxes to the IRS or think you may owe unpaid taxes you can call the IRS directly at 800-829-1040.

If you live in one of the. The tax withholding assumes 26 weeks of UI benefits not 9 months plus boosts of 600 and 300 for 16 and 6 weeks respectively. On 10200 in jobless benefits were talking about 1020 in federal taxes that would have been withheld.

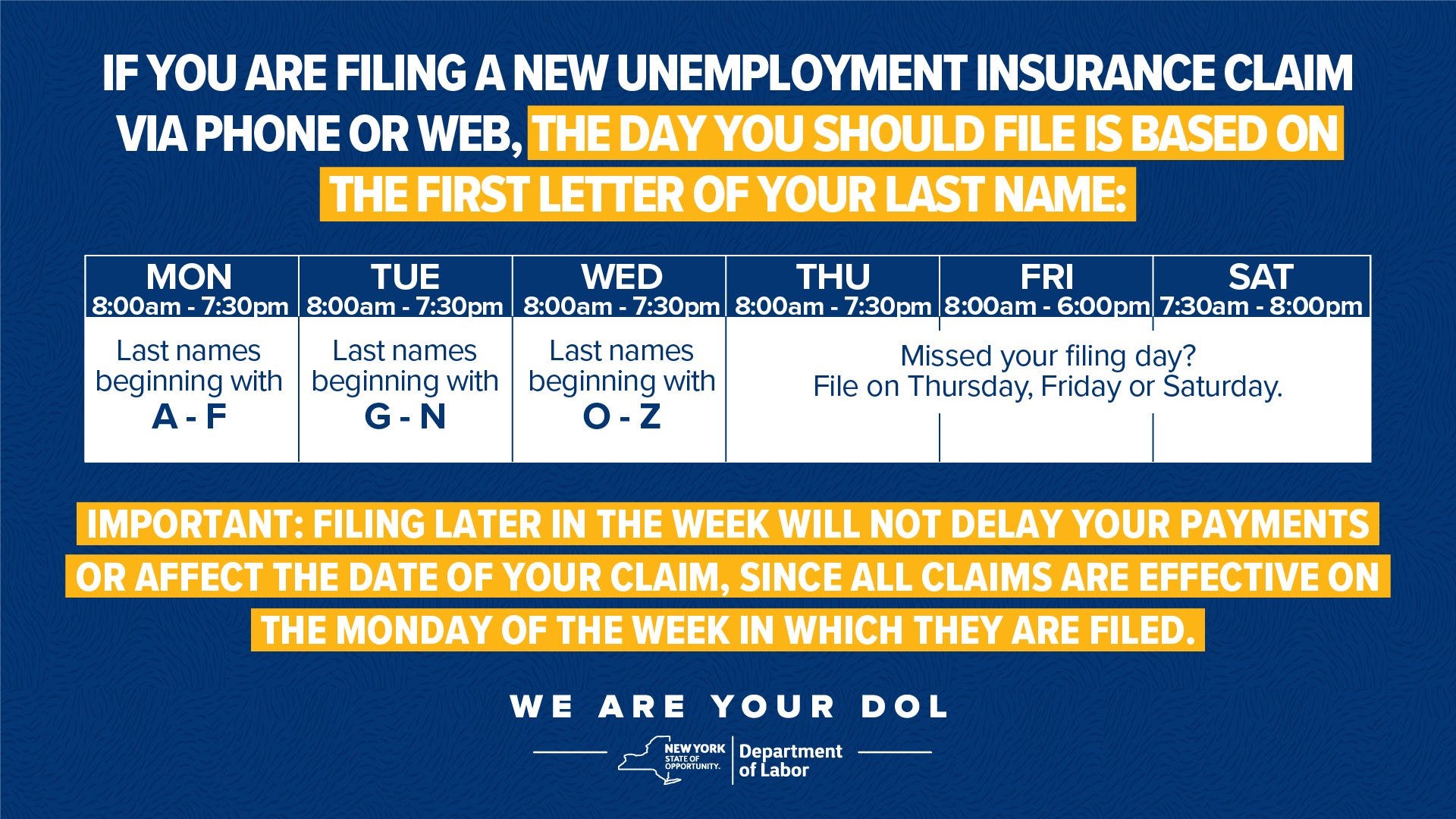

You can do the same thing with unemployment income. In many states such as New York all unemployment benefits are still subject to state taxes. Depending on the state you live in you may owe state.

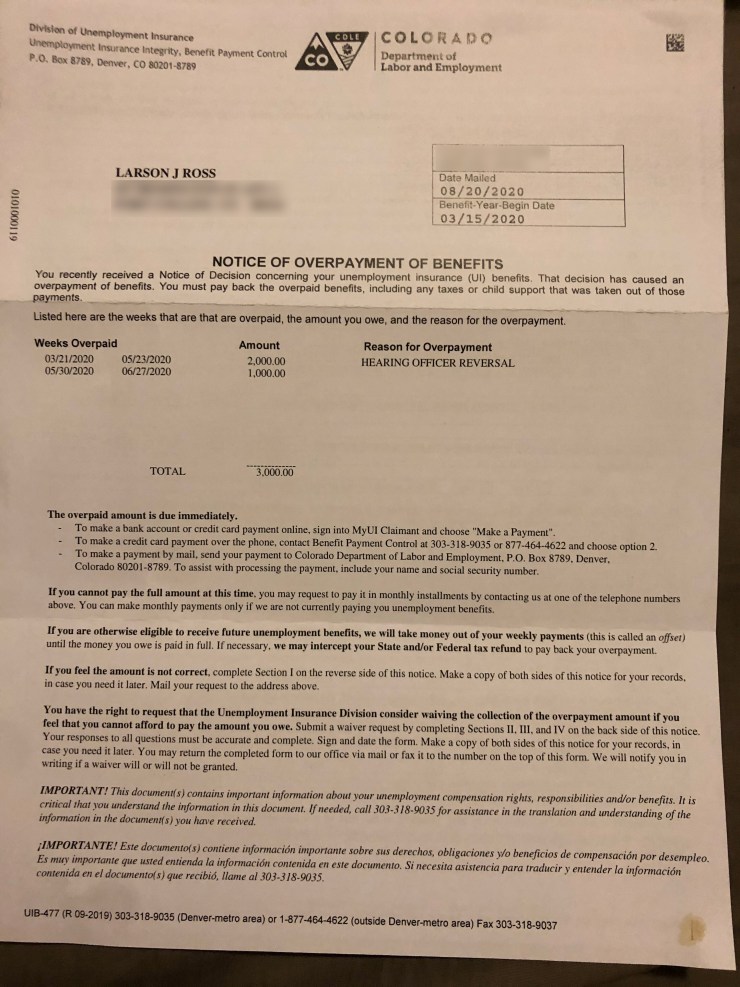

Unemployment Benefits And Taxes Here S What To Do About Incorrect Tax Forms And Other Issues The Denver Post

Beware Of The Unemployment Benefit Tax Bite What You Need To Know

Unemployment Taxes Will You Owe The Irs Credit Com

Irs Automatically Sending Refunds To People Who Paid Taxes On Unemployment Benefits The Washington Post

What Are Employer Taxes And Employee Taxes Gusto

Unemployment Benefits And Taxes Connect

States Are Telling Some People To Pay Back Unemployment Benefits Marketplace

How To Get A Refund For Taxes On Unemployment Benefits Solid State

How Is Unemployment Taxed Forbes Advisor Forbes Advisor

Here S Information On Why Unemployment Is Taxable In Colorado 9news Com

United States I Own And Run A Business Today I Received From Nys That I Owe Money On Taxes For Unemployment Insurance That I Received I Never Filed It Personal

State Income Tax Deadline Pushed Back To June Most 2020 Unemployment Benefits Will Be Exempt From Taxes Little Village

Unemployment Benefits Tax Issues Uchelp Org

Top Questions And Answers About Unemployment In Washington State King5 Com

State Income Tax Returns And Unemployment Compensation

Unemployment Benefits Tax Issues Uchelp Org

Can The Irs Take Or Hold My Refund Yes H R Block

Get Ready To Owe Lots In Taxes Over Covid 19 Unemployment Benefits Iheart

Texas Is Underfunding Unemployment To Keep Business Taxes Low Now It Owes 7 Billion And Counting Tpr